By

Ecential Team

May 19, 2025

•

Updated:

May 19, 2025

•

5 min read

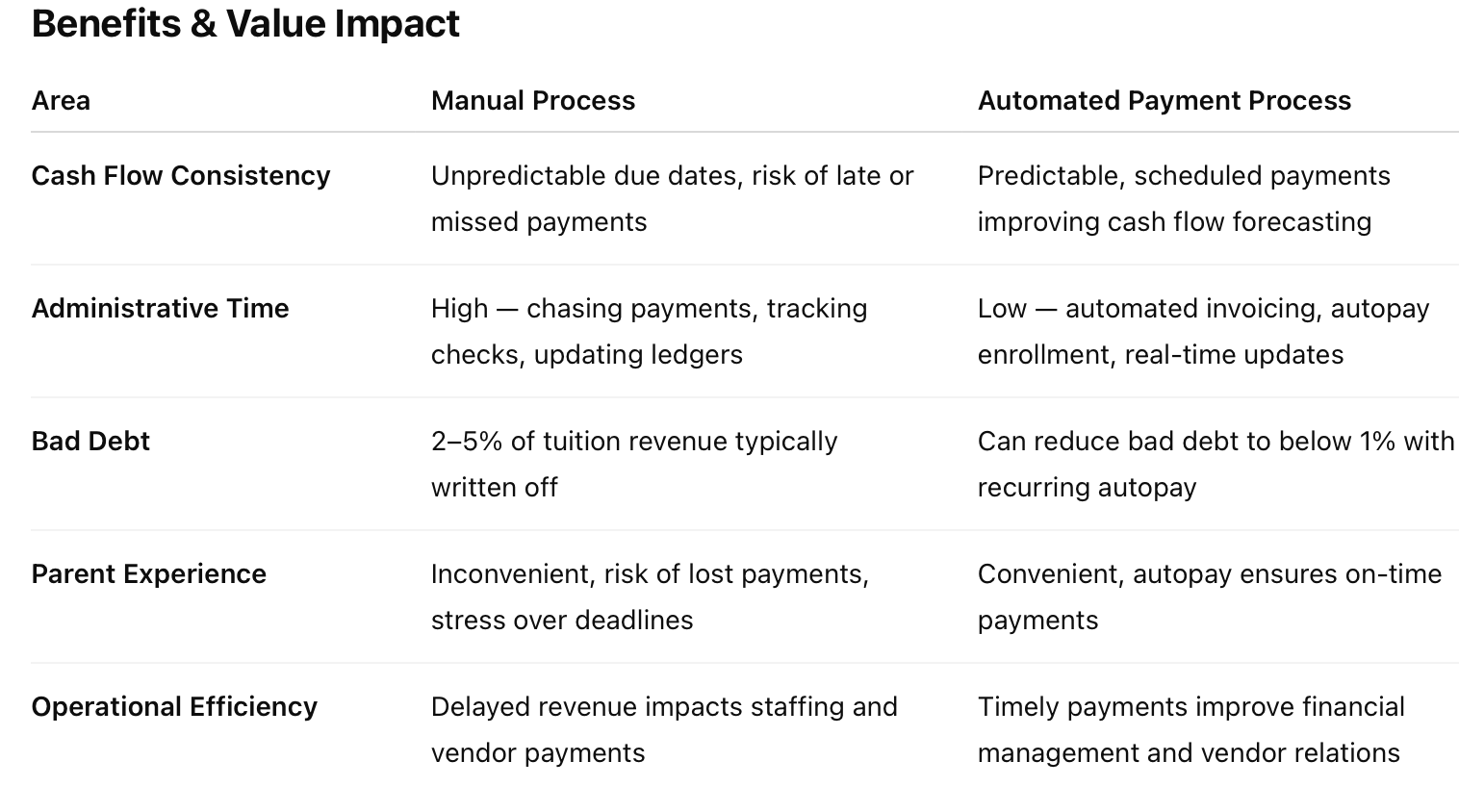

Childcare centers frequently struggle with inconsistent cash flow and overdue tuition payments. Manual invoicing and check payments increase administrative workload and increase the risk of late or missed payments, which can result in bad debt write-offs and operational cash flow challenges.

Implementing automated payment solutions through ACH (bank transfer) and credit/debit card processing can provide predictable, reliable cash flow, significantly reduce overdue balances, and improve financial management.

Industry Note: According to the National Child Care Association, the average center writes off 2–5% of annual tuition revenue as uncollected bad debt.

We created a simple table to highlight the pros and cons of manual vs. automated digital payments for you below:

But how much can it really save you? Well, we ran the numbers for you and you might be surprised. Check out this business case:

Assuming a center with:

Current bad debt (3% average):

$34,560 annually

Projected bad debt after automation (<1%):

$11,520

Annual recovery:

$23,040

Plus: Admin time savings (~8–10 hrs/month) = 120 hrs/year

At $20/hour = $2,400/year saved

Total Annual Financial Impact:

$25,440

This doesn't even take into account other time and money savings and also less stress for families, which can impact retention.

Here are some steps on how to get started:

Implementation Overview

Automating tuition payments through ACH and credit card processing isn’t just a convenience — it’s a strategic financial decision. It stabilizes cash flow, reduces bad debt, improves administrative efficiency, and creates a seamless experience for families.

Recommendation: Move forward with automating payments within the next quarter to capture immediate operational and financial benefits.